Chinese government offers

increasing support to alfalfa planting recent years, with so far the growing

area of alfalfa for sale has exceeded 100,000 ha, and output in 2015

hit over 1.2 million tonnes. As the national strategy to

promote the planting of feed instead of grains is promoted nationwide, CCM predicts, alfalfa planting is expected to develop

better, further, benefiting the dairy farming industry.

Source:

Baidu

The development of alfalfa

planting means a lot to dairy farming industry. Xu Simin, editor of Dairy

Product China News, introduces that the production cost of milk in China is

about USD406-481.2/t, of which feed costs make up 60-70%, reflecting widespread

use of imported high-cost feeds. That’s one of the main reasons why China’s dairy

farming cost remains high for a long time.

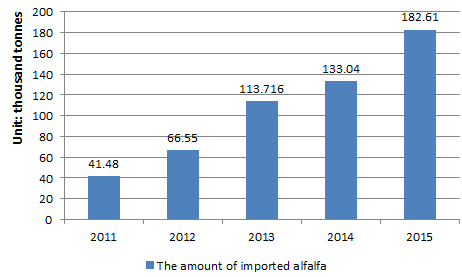

Alfalfa is a key example:

currently China has become the world's large alfalfa importer. According to

China Customs, it imported 1.2 million tonnes in 2015, up by 37.2% YoY. In

January-May this year the volume of 552,900 tonnes was up by a further 26.8%

YoY. The imported alfalfa amount from the US made up 86.1% of the 2015 volume,

followed by Spain at 11.2%.

Amount of imported

alfalfa in China, 2011-2015

Source: China’s Customs

& CCM

Despite

the large planting area, in 2012 the area used to produce alfalfa for sale was

only about 60,000 ha, with an output of about 700,000 tonnes - a low

industrialisation level. Besides, the price of domestic alfalfa is about 70% of

the imported price of USD315/t in January-May 2016.

In

fact, in 2012 China has begun to promote the development of domestic forage grass

industry, such as alfalfa and oats, so as to lower the dependency for import

and production cost.

In

June 2012, China’s Ministry of Agriculture and Ministry of Finance jointly

implemented the “Alfalfa Development Plan for Developing the Dairy Industry

Vigorously” program: during the 3-year pilot scheme, the central government

allocated USD45.1 million each year to support the construction of high-yield

planting demonstration zones. A one-time subsidy of USD270, 700 was given for

every 200 ha as a unit, especially intended to promote premium varieties, the

application of improved production technology, the improvement of production

conditions and quality management.

The zones were mainly targeted

at areas with production advantage and high levels of dairying, covering 10

provinces/ municipalities/ regions: Heilongjiang, Jilin, Liaoning, Hebei,

Shaanxi, Gansu provinces, Inner Mongolia, Ningxia and Xinjiang autonomous

regions and Tianjin. The result was that the output of premium alfalfa for sale

in 2014 surpassed 1 million tonnes (vs. around 150,000 tonnes before), although

this was only able to meet feed demand from about 1 million milking cows.

Then in 2015 the government

issued the Central No.1 Document to accelerate the development of grass/

pasture industries: targets for 2020 include:

-

Total production of fresh grass/ pasture (incl. alfalfa, silage corn

and oats) on natural grassland of 1.1 billion tonnes

-

Vegetation coverage on grass land of 56%

-

Growing area of 23.3 million ha

-

Milk production (incl. goat/ cow milk, etc.) of at least 41 million

tonnes

All of them can be seen as a

sign of continuous support from government at present and in the future. So far

the growing area of alfalfa for sale has exceeded 100,000 ha, and output in

2015 hit over 1.2 million tonnes.

In

this context, more and more domestic dairying groups are increasing their focus

on domestic alfalfa. China Huishan Dairy Holdings Company Limited, Inner

Mongolia Saikexing Breeding and Reproductive Biotechnology (Group) Co., Ltd.

and China Modern Dairy Holdings Ltd., have all been promoting an integrated

“planting-farming-processing” business model for some time, making them the top

3 users of domestic alfalfa, with usage of at 83,000 tonnes, 75,000 tonnes and

34,900 tonnes respectively (produced and purchased combined).

Currently, the national

strategy to promote the planting of feed instead of grains is promoted

nationwide, since China cancelled the corn temporary reserve policy. Various

local governments are developing programs to put this strategy into effect. For

instance, Gansu Province plans to establish another 666,700 ha grass/ pasture

(producing mainly for sale) in the 13th Five-year Plan period

(2016-2020) - this includes bases of 66,700 ha premium alfalfa (for sale) in an

irrigated region and a 233,300 ha alfalfa (for sale), in an arid region.

More related information in CCM’s Online Platform

If you

want to know more about information about dairy in China, you can enter our Online Platform for it.

It mainly concludes:

• Newsletters: You to

catch the latest news about dairy industry, including the Suppliers, traders,

consumers, price, export, import and government policies and so on.

• Company profile: You can

get the detailed information of public and private Chinese companies within the

industry.

BOON: Now you can enjoy the free trial in the Online Platform for 7

days. If needed, welcome to contact us directly by emailing econtact@cnchemicals.com or

calling +86-20-3761 6606.

About CCM:

CCM is the

leading market intelligence provider for China’s agriculture, chemicals, food

& ingredients and life science markets. Founded

in 2001, CCM offers a range of data and content solutions, from price and trade

data to industry newsletters and customized market research reports. Our

clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of

Kcomber Inc.

For more

information about CCM, please visit www.cnchemicals.com or get in touch

with us directly by emailing econtact@cnchemicals.com or

calling +86-20-37616606.

Tag: alfalfa feed dairy